1st Annual Momentous Music Fest

The 1st Annual Momentous Live Music Fest with music from Tim Mahoney, Mike Beigle, Tim Griesgraber, and Brian David.

All proceeds go to the Amie Muller Veteran Health Research Program and Research Fund.

Saturday, May 18th from 6-9pm

3rd Act Brewery, Woodbury MN

This event is FREE to attend, but we would love it if you donated to the Amie Muller Veteran Health and Research Program and Research Fund at:

https://burnpits360.org/blogs/news/announcing-the-tsgt-amie-muller-veteran-health-research-program-and-research-fund

Pickleball 4.0 Classic

Compete in the Momentous 4.0 Pickleball Classic at The Burrow in Oakdale on Sunday, April 28th. Limited to 16 teams. The entry fee is $75/ team. Doubles only. Play begins at 8:30.

1st Place- $500

2nd Place- $250

3rd Place- $100

Register at: https://app.courtreserve.com/Online/Account/LogIn/9995

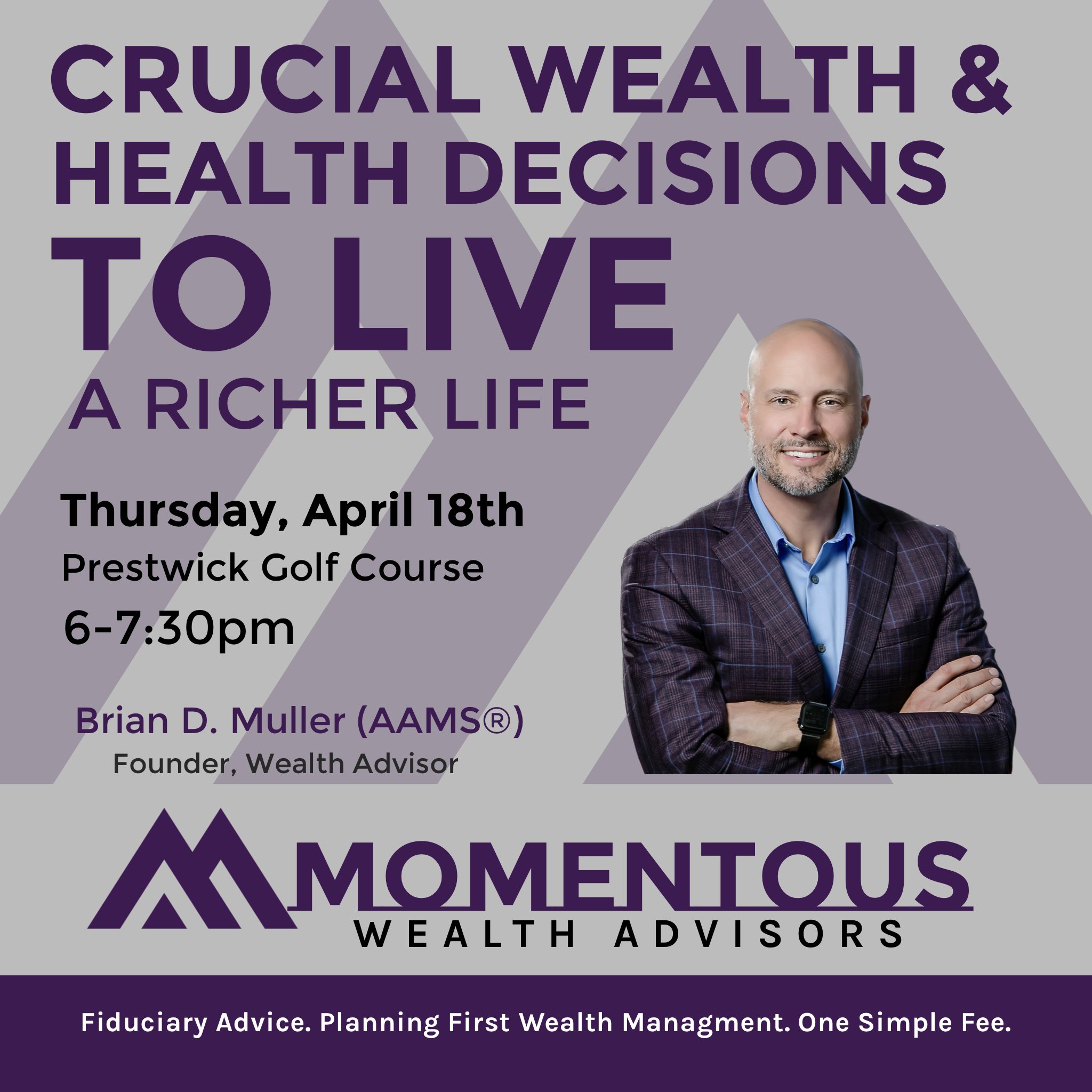

Special Event

I've been studying the markets since I was 18 and have been a financial advisor for over 20 years and am also a certified Health and Life Coach. Throughout my experience as a financial advisor and investor, I've learned many valuable financial lessons. The Top 5 Wealth Decisions we will be discussing in this special event can help you establish a foundation for a richer life for you and your family.

More Wealth + Better Health = Richer Life

I will also be joined by special guest speakers from SPENGA Fitness and Matt Hill from Chiroway who will be talking about some of the most important health decisions to live a better life.

Thursday, April 18th- 6-7:30 pm

Prestwick Golf Course

Space is limited: RSVP by clicking on the view event link

What Makes Momentous Wealth Advisors Different?

Listen to Brian D. Muller, Founder and Senior Wealth Advisor talk about the Momentous Wealth Difference.

The Momentous Wealth Difference by Brian Muller, Founder and Senior Wealth Advisor

Our Investment Principles

Asset Allocation is critical and a key driver of long-term results. Having the right mix for your stage of life will be more important over time to help reach your most important financial goals.

Stay Invested- Market Timing simply does not work. If you get out of the market, you will always find a reason not to get back in. Learn more here.

*Don’t Chase Performance- What did well this year, may not do well next year.

Diversify- Having the right mix of investments will lower your volatility and give you more consistent returns over time to achieve your goals.

Avoid Over-Concentration - Don’t own more than 10% in any one company.

Rebalance Regularly- A 70/30 mix of stocks and bonds will eventually not be. Keep your mix aligned with your goals and your financial plan.

Passive investment Strategies are an important component of a portfolio to keep fees low.

Ignore The Noise- Press makes noise to sell advertising. Markets will fluctuate. Stay focused on your plan.

Don’t Play Politics With Your Investment Strategy- We can’t predict who will take office. There is a lot of misconceptions and opinions on what will happen if one party gets into office versus the other. Learn more here.

*Nothing shows Principle #3 better than the Callan Periodic Table of Investment Returns. It depicts annual returns for key asset classes, ranked from the best to worst performance for each calendar year from 2004-2023. Click below to view.

Does Your Portfolio Fit You?

Ambiguous terms such as "conservative" or "moderately-aggressive" cause confusion in the investment arena. That is why we use Riskalzye™ by Nitrogen Wealth, because generalizing client risk tolerance doesn't work. Investors view risk through their own, unique lens to gauge risk and return tradeoffs.

The Risk Number® is an objective, mathematical approach to removing subjectivity by quantifying the risk of investors and portfolios. The Risk Number is calculated based on downside risk. On a scale from 1 to 99, the greater the potential loss, the greater the Risk Number.

Watch the Video Below To Learn More: